Copper is not quite sure what to do with the numbers. While copper bulls are glad to see the stronger data, copper bears are of the view that the growth is not fast enough to sustain significantly higher prices for the metal. It did manage a breakout above that resistance zone on its chart and notched a nearly 4 month high today but it appears to be a bit hesitant to extend strongly higher yet. One gets the idea that while sentiment towards copper is markedly improved, that folks are wondering just how much strength in the global economy there is. It may have to wait until this Thursday when we get the payrolls numbers before it makes a bigger move.

For now, while traders may not feel confident enough about it to chase it higher, they look to be ready to buy dips. Chinese double counting and triple counting fears seem to be well in the rear view mirror at this point.

It is interesting to note the action in crude oil in today's session. Brent crude liked the manufacturing data, especially from China, and WTI did as well, but it has faded nearly $1.00/bbl as I am typing these comments up. As I was going over the last COT reports for crude this past Friday, I noticed that the massive, net long position of the hedge funds had been whittled back somewhat. While sentiment towards crude among that group was still extremely bullish, they were pulling some money off of the table. I am watching this closely to see if they will come back in with fresh money at the start of this new month or if they are content to take profits on subsequent rallies higher.

For now, price has stalled up near $107.50 and has retreated to the point of the previous breakout, namely the $105 level. Support extends down from this level towards $104.50. Thus far the market is showing no signs of breaking down as support is holding but with that very large hedge fund long position in this market, any break of a chart support level will get mighty interesting, might fast. Price could fall, in the event of a bout of long liquidation, as far as $103.50 or so and do no damage to the bigger uptrend.

Crude's behavior, along with copper, should tell us a great deal about what big-monied speculative interests are thinking in regards to global and domestic growth.

Grains and beans continued moving lower today. Yesterday's crop condition reports were just icing on the cake as far as the bears were concerned. That earlier report showing the stunningly large bean acreage set the tone and it has been negative since. The corn condition actually got even better ( 75% Good/Excellent) in the conditions report yesterday afternoon.

The chart scored a near 5 month low today.

Finally! We finally got an updated number from the GLD holdings yesterday. It showed a nice influx of some 5.05 tons of gold since the last updated number. That is a nice "positive" strike three. I mean by that, you had the gold price moving higher yesterday, the mining shares moving higher and the GLD showing an increase of 5 tons. That is exactly what one wants to see if they are a gold bull. That, plus the fact that the US Dollar index fell below 80 on its chart.

Gold moved higher in spite of the fact that crude oil moved lower yesterday and the grains imploded. That is even more impressive.

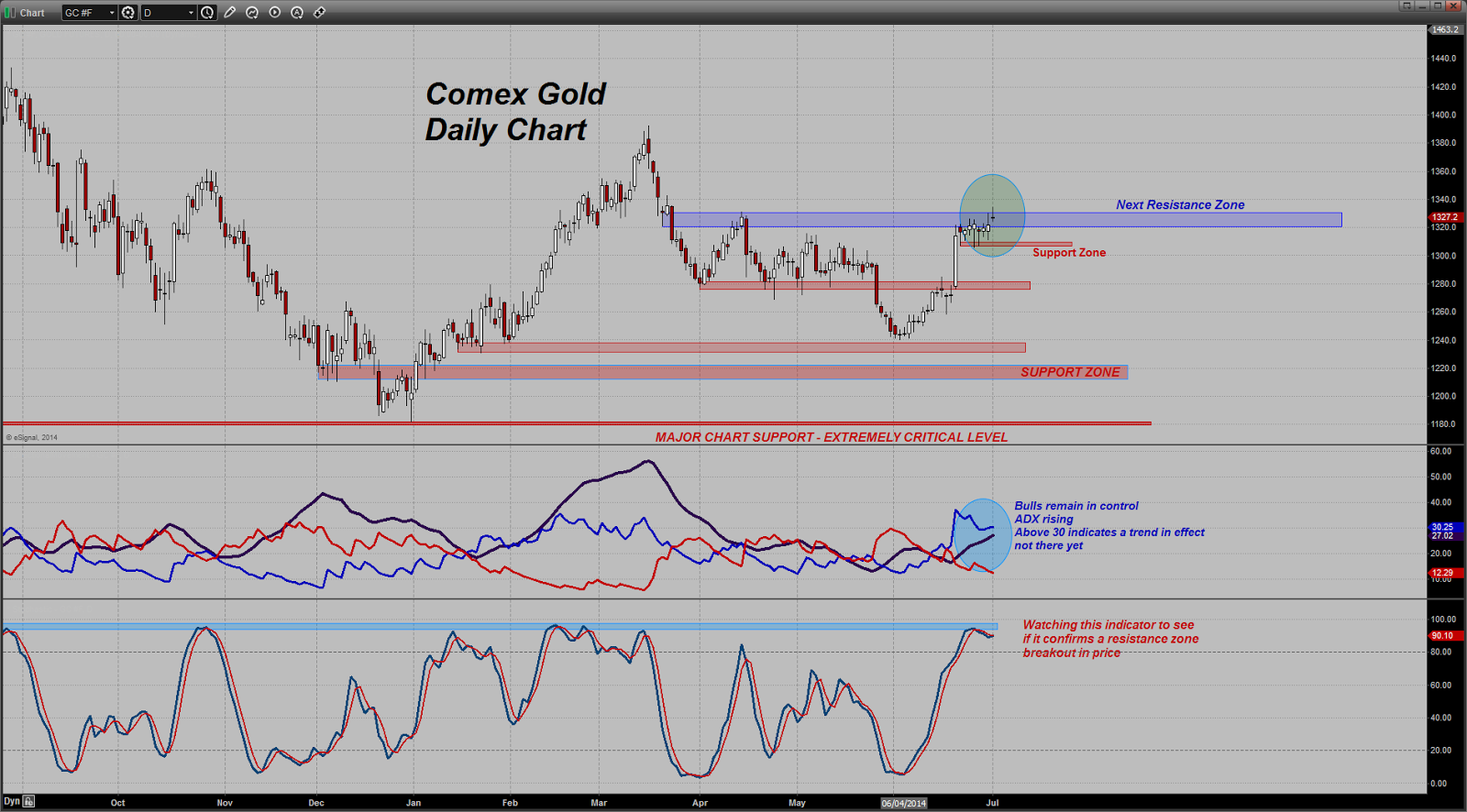

As far as today's price action goes for the yellow metal, it is attempting to break through and away from this resistance zone noted on the chart. Like copper, the market appears to be pausing here to evaluate the current price level. Bulls appear hesitant to get too aggressive while bears are trying to dig in.

If we get a clean push past the top of this zone, the next target is up near the $1360 level. If that were to give way, $1390 comes into play.

I am closely watching the ADX and some other indicators to see whether this market is going to reverse here or will extend. Ranging indicators are near overbought levels commensurate with moves lower in price. However, and this is important, bulls need to push price up to get us to move away from the range trade indicators to the trending indicators. They have not done that yet ( they are close however).

Price could fall back towards $1305 - $1306 and still be okay but bulls would not want to see that fail or it would portend a deeper retracement lower, especially if the market were to lose psychological support at $1300.

For now we wait. Longs - stay sharp here and be alert. One wonders if yesterday's big buyers will return right away or will wait for a dip lower.