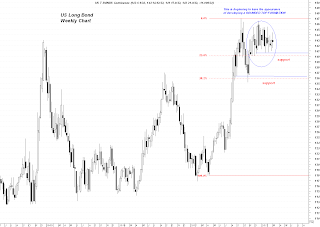

Please see the following charts for some comments on the US long bond market - in my opinion this is the SINGLE MOST IMPORTANT MARKET ON THE PLANET.

The weekly chart is very interesting as it shows a market that has the POTENTIAL (not there yet) to be developing a ROUNDED TOP FORMATION. That pattern is an especially reliable one because it indicates a SLOW but STEADY SHIFTING OF SENTIMENT occurring over a generally longer period of time as the realization slowly dawns on traders that the fundamentals are shifting in the other direction. This formation will not be validated unless we get a strong breach of downside support.

I have noted two of the nearest Fibonacci Retracement Levels where support for the bonds might arise. These areas will bear watching if for some reason the Federal Reserve cannot sustain its "PROP UP THE BONDS" operation.

DO NOT FORGET - the one thing most dreaded by the Fed in addition to the US Treasury Department is rising long term interest rates because of the mathematics involved in servicing the gargantuan and disgustingly pathetic level of US debt. Interest payments on the US debt are going to be consuming a larger and larger share of future government revenues in the months and years ahead. At some point, it will break the back of our nation. Thus the necessity of the Fed playing around in that market artificially suppressing the rate of interest at the long end of the curve.

I am strongly of the opinion that this reason was the SINGLE LARGEST DETERMING FACTOR behind Wednesday's orchestrated hit of the commodity sector and particularly the precious metals. Bernanke and company have categorically and continually dismissed all critics of their near-zero interest rate policy as engendering inflation by dismissing those concerns with statements to the effect that inflation is "modest, contained, temporary, etc."

They must continue this charade if they are to keep the bond market from collapsing to the downside with the subsequent onset of a rising interest rate environment. Bond traders have thus far been prevented from aggressively pushing on the short side of this market due to direct Federal Reserve involvement in that market. Should there be any shift towards an inflation bias that takes hold among those who trade or hedge in this market, those forces would overwhelm Fed efforts to artificially push it higher (yields lower).

A rising gold price strikes at the very heart of their supposition that inflation is subdued and there are little if any consequences arising from a policy that by its very nature is one which debases a currency. That is why this messenger (gold) must be discredited if the FED itself is to RETAIN ANY CREDIBILITY.

To witness a $100 drop in the price of gold within a few hours time and to have it explained by analysts who should know enough about market action to explain it as "disappointment in the lack of an imminent QE3" is laughable were it not so utterly wrongheaded. As stated in Wednesday's column, the Fed must not have commodity prices surging higher while they pursue a policy that has never failed to weaken or undercut the "value" of any currency whenever or wherever it has been plied.

When the Fed gives the hedge funds the green light to shove Equity prices higher after promising no hikes in interest rates until the latter half of the year 2014, they "expect" the hedge funds to be "well behaved" and not to jam a goodly portion of that hot money as well into commodities but rather direct their fire power into the equity world at which point the politicians and monetary authorities can bask in the accolades of the vast majority of what has become a dumbed-down citizenry who think that a rising stock market signifies a healthy economy.

Most distressingly to the Fed, the hedgies are not being compliant servants but had the audacity to chase the commodity complex higher and begin pushing not only energy but food prices higher once again, not to mention the bellwether metals complex. Were that to continue unabated, the bond market, which was crushed on that Wednesday and then on Thursday, would see buying support beneath it evaporate. Hence a pause or a time out was necessitated in the commodity complex rise which the Fed managed to secure by week's end based on the CCI.

Stay tuned as we are witnessing what I am coming ever more strongly to believe is the end game for this horrible experiment gone awry.

"When misguided public opinion honors what is despicable and despises what is honorable, punishes virtue and rewards vice, encourages what is harmful and discourages what is useful, applauds falsehood and smothers truth under indifference or insult, a nation turns its back on progress and can be restored only by the terrible lessons of catastrophe." … Frederic Bastiat

Evil talks about tolerance only when it’s weak. When it gains the upper hand, its vanity always requires the destruction of the good and the innocent, because the example of good and innocent lives is an ongoing witness against it. So it always has been. So it always will be. And America has no special immunity to becoming an enemy of its own founding beliefs about human freedom, human dignity, the limited power of the state, and the sovereignty of God. – Archbishop Chaput

Trader Dan's Work is NOW AVAILABLE AT WWW.TRADERDAN.NET

Friday, March 2, 2012

Gold Chart comments

The Daily Chart is pretty clear as to the larger resistance and support levels. Those remain the same as they had been previous to the strong upside moves on Monday and Tuesday of this week. The sell off was contained on the downside by the same level support that has held for over a month now. Value buyers continue to surface near and just below the $1700 level. Reports of very strong increases in physical offtake are surfacing out of Asia on such dips in price.

This buying is not of the nature that it chases prices higher; that requires the momentum crowd (hedge funds in particular) many of which were run out of their long positions on Wednesday's rout. For that crowd to come back in, gold will need a return TO AND THROUGH the $1750 level.

Last week I posted a weekly chart detailing the BULLISH FLAG OR PENNANT FORMATION which had developed. I also gave a price projection based on that pattern noting that this pennant would remain in force unless we got a move in the price that TOOK US BELOW THE BOTTOM OF THE FLAG. That did occur with this week's outside reversal pattern so the price projection from that flag is no longer immediately in effect.

What we have now on the weekly chart is a powerful upside formation clashing with a powerful downside formation. The fact that gold did spike through the bottom of that flag only to recover above $1700 is encouraging. It looks to me like we have a setup that is more conducive to a consolidation type trade (sideways movement) rather than the setup for a sustained downdraft. The longer gold holds above $1680-$1690, the better the odds become of this becoming a new base from which the next leg higher will commence.

Note that the moving averages I like to use to get a sense of the prevailing trend (10, 20, 40 and 50 week) are all moving higher indicating that the weekly trend still remains up.

Price did come down and touch both the 10 week and the 20 week moving averages and bounced from there. The 50 week moving average has seen only one close below it in the time frame shown but immediately recovered the following week. The 40 week moving average (dotted line) has also served as a support level on several occasions. It was not reached in this week's sell off. The only reason I would become the least bit concerned about a longer correction being in store for gold were it to get TWO CONSECUTIVE WEEKLY CLOSES BELOW THE 50 WEEK MOVING AVERAGE.

In short, the longer term trend is up.

Silver retreats from Resistance but holding Support

Silver bulls could not take the metal through the resistance zone near $35.50 so the market has now retreated lower as longs take profits and some new shorts sell against that level. Support remains down near the $34 level and the spike low from Wednesday's wild takedown.

Subscribe to:

Posts (Atom)